Personal finance encounter few obstacles such as large as debt. It acts as a heavy weight, pressing down on your financial well-being and making it seem nearly impossible to adhere to a budget and reach the financial goals you’ve set for yourself. With the implementation of effective strategies, debt management and budgeting can become powerful allies, working together to pave your path towards a future of financial freedom. This approach allows you to not only chip away at your existing debt but also to create a sustainable spending plan that ensures you stay on top of your finances and move steadily towards achieving your long-term aspirations.

What is a debt?

Before we explore debt management strategies, it’s essential to establish a firm grasp on what debt truly is and the far-reaching consequences it can have on your overall financial health. In essence, debt can be understood as an advance of money obtained from a lender, with a binding agreement to repay the borrowed amount in full at a future date. This repayment typically comes with additional charges in the form of interest. While certain types of debt, such as mortgages or student loans, can be viewed as strategic investments that pave the way for a brighter financial future, others, like credit card debt or personal loans with exorbitant interest rates, can snowball into significant financial burdens if not managed effectively.

The Challenge of Budgeting with Debt:

Debt can act like a roadblock on your financial journey, significantly hindering your ability to effectively budget. Each month, a portion of your income gets diverted towards debt repayments, leaving a smaller pool of money to allocate towards other essential expenses and long-term savings goals. This can quickly disrupt your budgeting efforts. Imagine a carefully planned budget as a meticulously built sandcastle. High debt payments act like a relentless wave, constantly washing away sections of your castle, leaving it vulnerable and unstable.

Essential expenses like rent, groceries, and utilities become more challenging to cover, and dreams of saving for a car, a house, or a secure retirement can feel increasingly distant. The absence of a clear strategy for managing debt within your budget creates a vicious cycle. The more you struggle to meet your basic needs due to debt repayments, the harder it becomes to save money to pay down that very debt. This financial strain can snowball into a significant source of stress, impacting your well-being and potentially hindering your ability to make clear financial decisions.

Read this: Debt Management Blueprint for Individuals & Businesses: Building Wealth, Not Debt

Strategies for Debt Management and Budgeting:

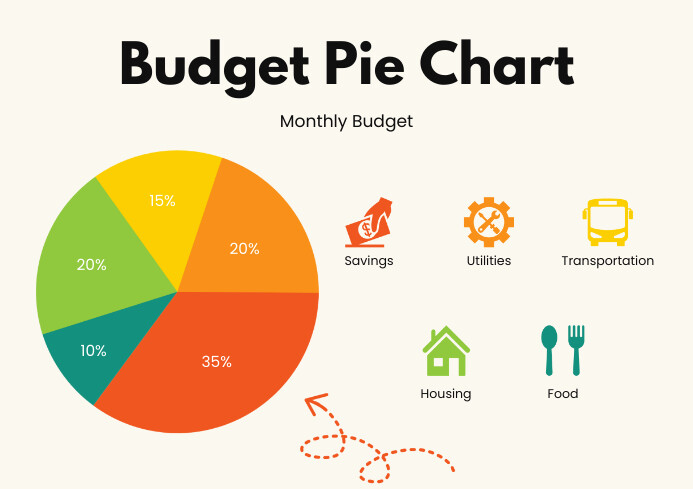

- Create a Comprehensive Budget: The first step in managing debt and budgeting effectively is to create a comprehensive budget that outlines your income, expenses, and debt obligations. Start by listing all sources of income, including wages, bonuses, or any other sources of revenue. Next, categorize your expenses into fixed expenses (such as rent or mortgage payments) and variable expenses (such as groceries, utilities, and entertainment). Finally, identify your debt obligations, including minimum monthly payments and interest rates.

- Prioritize Debt Repayment: Once you have a clear picture of your financial situation, prioritize debt repayment within your budget. Allocate a portion of your income towards paying off debt each month, focusing on high-interest debt first to minimize interest costs over time. Consider using the debt avalanche or debt snowball method to accelerate debt repayment and stay motivated. With the debt avalanche method, you prioritize paying off debts with the highest interest rates first, while the debt snowball method involves paying off the smallest debts first to build momentum.

- Negotiate Lower Interest Rates: If you’re struggling with high-interest debt, consider negotiating lower interest rates with your lenders. Contact your creditors directly to inquire about options for reducing interest rates, such as transferring balances to lower-rate credit cards or consolidating loans into a single, lower-rate loan. By lowering your interest rates, you can reduce the total cost of borrowing and accelerate debt repayment, helping you achieve financial freedom sooner.

- Cut Expenses and Increase Income: To free up more money for debt repayment within your budget, consider cutting discretionary expenses and finding ways to increase your income. Look for opportunities to reduce non-essential spending, such as dining out less frequently, canceling unused subscriptions, or finding more affordable alternatives for everyday expenses. Additionally, explore options for increasing your income, such as taking on a part-time job, freelancing, or selling unused items. By trimming expenses and boosting income, you can allocate more funds towards debt repayment and expedite your journey towards financial freedom.

- Build an Emergency Fund: While it’s important to prioritize debt repayment, it’s equally crucial to build an emergency fund to cover unexpected expenses and avoid going further into debt. Aim to set aside at least three to six months’ worth of living expenses in a separate savings account designated for emergencies. Having an emergency fund in place can provide a financial safety net and prevent you from relying on credit cards or loans to cover unforeseen costs, ultimately helping you stay on track with your debt repayment goals.

- Seek Professional Guidance: If you’re struggling to manage debt and budget effectively on your own, don’t hesitate to seek professional guidance from a certified financial planner or credit counselor. These professionals can offer personalized advice and guidance tailored to your unique financial situation, helping you develop a comprehensive debt management plan and establish healthy budgeting habits for the long term. Whether you need assistance negotiating with creditors, consolidating debt, or creating a realistic budget, a financial expert can provide valuable support and resources to help you achieve your financial goals.

Managing debt and budgeting effectively can be challenging, but with the right strategies and discipline, it’s possible to overcome financial obstacles and achieve long-term financial stability. By creating a comprehensive budget, prioritizing debt repayment, negotiating lower interest rates, cutting expenses, increasing income, building an emergency fund, and seeking professional guidance when needed, you can take control of your finances and pave the way towards a brighter financial future. Remember, the journey towards financial freedom may require patience and persistence, but the rewards of financial independence are well worth the effort.