In the principality of finance, few numbers carry more weight than your credit score. It acts as a key metric, influencing everything from securing a mortgage to getting approved for a new phone plan. Landlords might even consider it when reviewing rental applications. Understanding what constitutes a good credit rating and how it impacts your financial opportunities is crucial. Being financially literate means knowing how to monitor and improve your credit score, in the long run unlocking better loan terms and opening doors to a wider range of financial products.

What is a Good Score?

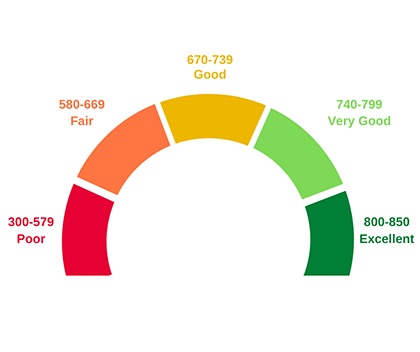

A good credit worthiness serves as a testament to your financial responsibility and creditworthiness in the eyes of lenders. Credit scores typically range from 300 to 850, with higher scores indicating lower credit risk. While specific thresholds may vary slightly among credit reporting agencies, a general classification of credit scores can be outlined as follows:

- Poor Credit (300 – 579): Individuals with credit scores falling within this range are considered high-risk borrowers, often facing challenges in securing loans or credit cards. Poor credit may stem from a history of missed payments, defaults, or bankruptcy filings.

- Fair Credit (580 – 669): Fair credit signifies an improvement over poor credit but still suggests elevated risk to lenders. While individuals in this category may qualify for some financial products, they are likely to encounter higher interest rates and less favorable terms.

- Good Credit (670 – 739): A credit score in the range of 670 to 739 is generally deemed good, indicating a moderate level of credit risk. Borrowers with good credit are typically eligible for a wide array of financial products and may enjoy more competitive interest rates and advantageous terms.

- Very Good Credit (740 – 799): Falling within this range signifies a high level of creditworthiness, with borrowers demonstrating responsible financial behavior and minimal credit risk. Individuals with very good credit scores are often offered preferential terms and may qualify for top-tier financial products.

- Excellent Credit (800 – 850): An excellent credit score represents the pinnacle of creditworthiness, reflecting impeccable financial management and minimal risk to lenders. Borrowers in this category are highly sought after by financial institutions and typically enjoy the most favorable terms and conditions on loans and credit cards.

What Does My Credit Score Mean?

Your credit ratings serves as a numerical representation of your creditworthiness, providing lenders with a quick and standardized assessment of your likelihood to repay debts responsibly. Several factors contribute to the calculation of your credit worthiness, with the following elements carrying varying degrees of significance:

- Payment History: The timeliness and consistency of your debt repayments constitute the most influential factor in determining your credit score. Late payments, defaults, and collections can significantly diminish your score, while a history of on-time payments enhances it.

- Credit Utilization Ratio: This metric compares your outstanding credit balances to your available credit limits across all accounts. Maintaining a low credit utilization ratio—typically below 30%—demonstrates responsible credit management and positively impacts your credit score.

- Length of Credit History: The duration of your credit accounts, including the age of your oldest account and the average age of all accounts, influences your credit score. A longer credit history reflects stability and may boost your score over time.

- Credit Mix: Lenders assess the diversity of your credit portfolio, including installment loans (e.g., mortgages, auto loans) and revolving credit accounts (e.g., credit cards, lines of credit). A balanced mix of credit types suggests financial versatility and can contribute positively to your credit score.

- New Credit Inquiries: Each time you apply for new credit, a hard inquiry is generated, potentially impacting your credit score. While occasional inquiries are normal, excessive applications within a short period may signal financial distress and negatively affect your score.

How Do I Check My Credit Score?

Monitoring your credit score regularly is essential for staying informed about your financial standing and detecting any discrepancies or fraudulent activity promptly. Several methods are available to check your credit score:

- Credit Reporting Agencies: Major credit bureaus such as Equifax, Experian, and TransUnion offer credit monitoring services that allow you to access your credit report and score online. Many of these services provide complimentary credit score updates at regular intervals or upon request.

- Financial Institutions: Some banks, credit unions, and credit card issuers provide customers with access to their credit scores as part of their online banking or credit card account management platforms. Check if your financial institution offers this feature.

- Credit Monitoring Apps: Numerous third-party apps and websites specialize in credit monitoring and offer free or subscription-based services to track your credit score and receive alerts regarding changes or potential issues.

- Annual Credit Report: By law, consumers are entitled to one free credit report from each of the major credit bureaus annually. Visit AnnualCreditReport.com to request your free credit reports, which can help you review your credit history and identify areas for improvement.

Read this: Debt Management Blueprint for Individuals & Businesses: Building Wealth, Not Debt

Improving Your Credit Score:

If your creditworthiness falls below the desired threshold or you simply aim to enhance your creditworthiness further, implementing proactive strategies can yield tangible results. Consider the following tips to improve your credit score:

- Pay Bills Promptly: Prioritize timely payments on all credit accounts, including loans, credit cards, and utility bills, to demonstrate reliability and bolster your payment history.

- Reduce Debt Balances: Aim to pay down outstanding balances on credit cards and loans, focusing on high-interest debts first. Lowering your credit utilization ratio can have a significant positive impact on your credit score.

- Avoid Opening Too Many Accounts: Limit new credit applications to avoid excessive hard inquiries and maintain stability in your credit profile. Opening multiple accounts within a short period can raise concerns about your financial stability and lower your score.

- Monitor Your Credit Report: Regularly review your credit report for inaccuracies, errors, or fraudulent activity that may negatively affect your credit score. Dispute any discrepancies promptly to ensure the accuracy of your credit profile.

- Maintain Long-Term Accounts: Retaining older credit accounts with a positive payment history can contribute to the length and depth of your credit history, bolstering your credit score over time.

In summary.

In the domain of personal finance, the credit score serves as a base of financial health and opportunity. Understanding the components of a credit rating, its significance in various financial endeavors, and practical steps to monitor and improve it is essential for achieving long-term financial success. By empowering yourself with knowledge and adopting responsible credit management practices, you can tackle the power of your credit score to unlock a world of financial possibilities and secure a brighter future.

Visit: Lizfinance