Sometimes or rather a high of percentage of individuals find it difficult to manage their debts while building their future. From student loan burdens to mortgages, car payments, and credit card balances, individuals and businesses alike grapple with various forms of debt. Yet, with the right strategies and a clear understanding of debt management principles, these financial challenges can be transformed into stepping stones on the path to long-term success.

Debt management, often a source of frustration and complexity, is demystified in this comprehensive guide. It offers a clear roadmap for individuals and businesses to not only regain control of their finances but also achieve sustainable growth.. We’ll explore the different types of debt, their unique characteristics, and the impact they can have on your financial health. We’ll equip you with helpful tips and actionable strategies to tackle debt head-on, from creating a personalized repayment plan to leveraging tools like debt consolidation. Whether you’re an individual struggling with credit card debt or a business owner managing loans, this guide will empower you to make informed decisions, optimize your debt management approach, and ultimately achieve financial freedom.

Remember, debt isn’t inherently negative. When managed effectively, it can be a powerful tool for building wealth, financing education, or expanding a business. This guide aims to equip you with the knowledge and tools to harness the positive power of debt while mitigating its risks. By the end of this journey, you’ll be armed with the confidence and strategies to transform debt from a burden into an engine for growth.

Understanding Debt Management:

In the realm of personal finance, debt management stands as a cornerstone of financial well-being. It’s a multi-pronged approach designed to tackle your existing financial obligations in a responsible and strategic manner. The process begins with a clear-eyed assessment of your current debts. This involves gathering information on interest rates, outstanding balances, and minimum payment requirements for each loan or credit card. Once you have a comprehensive picture, you can craft a structured repayment plan. This plan should prioritize debts based on factors like interest rate or balance size. Some popular strategies include the snowball method, which focuses on paying off the smallest debts first for a quick morale boost, or the avalanche method, which targets debts with the highest interest rates to save money in the long run.

Debt management doesn’t stop at repayment, however. It also involves implementing strategies to minimize the interest you accrue. This could involve negotiating lower rates with lenders or seeking out balance transfer opportunities with reduced introductory periods. Ultimately, effective debt management goes beyond simply paying off your debts. It’s a proactive strategy that alleviates the burden of financial stress, allowing you to breathe easier. The benefits extend far beyond immediate relief. As you diligently chip away at your debts and demonstrate responsible credit behavior, your creditworthiness improves. This translates to a higher credit score, which unlocks doors to better borrowing opportunities in the future, such as securing favorable interest rates on mortgages or auto loans. By taking control of your debt through effective management strategies, you’re not just tackling your financial obligations today, you’re paving the way for a more secure and prosperous future.

Read this: Stocks Vs Bonds – Analyzing Returns, Risks, and Market Trends for Informed Investing Decisions!

Key points to take note:

- Assessing Financial Situation: The first step in debt management is to assess your current financial situation comprehensively. This involves calculating total debt, including outstanding balances on loans, mortgages, credit cards, and other liabilities. Additionally, evaluating income sources, expenses, and cash flow patterns provides valuable insights into your ability to repay debts and formulate a realistic repayment plan.

- Creating a Budget: A well-defined budget is the cornerstone of effective debt management. By outlining income streams and categorizing expenses, individuals and businesses can identify areas where spending can be reduced or optimized to allocate more funds towards debt repayment. Budgeting tools and apps can streamline this process, offering real-time tracking and analysis to ensure financial goals are met.

- Prioritizing Debts: Not all debts are created equal, and prioritizing repayments based on interest rates and terms can optimize debt clearance strategies. High-interest debts such as credit card balances should be tackled first to minimize interest payments and accelerate overall debt reduction. Simultaneously, maintaining minimum payments on other debts helps prevent default and preserve credit scores.

- Negotiating with Creditors: In cases of financial hardship, negotiating with creditors can yield favorable outcomes such as reduced interest rates, extended repayment terms, or even debt settlements. Many creditors are willing to collaborate with borrowers facing difficulties, as they prefer receiving partial payments over risking default. Professional debt negotiators or credit counseling services can facilitate these negotiations on behalf of borrowers.

- Consolidating Debts: Debt consolidation involves combining multiple debts into a single loan with a lower interest rate or more favorable terms. This simplifies debt management by streamlining payments and potentially reducing overall interest costs. However, consolidation should be approached cautiously, weighing the benefits against any associated fees or risks, and ensuring that it aligns with long-term financial goals.

- Building Emergency Savings: An essential aspect of debt management is establishing emergency savings to cover unexpected expenses or income disruptions. Having a financial safety net reduces reliance on credit cards or loans during emergencies, preventing additional debt accumulation and safeguarding long-term financial stability. Aim to accumulate at least three to six months’ worth of living expenses in a readily accessible savings account.

- Seeking Professional Assistance: For complex debt situations or individuals overwhelmed by financial challenges, seeking professional assistance can provide valuable guidance and support. Certified financial planners, debt counselors, and bankruptcy attorneys possess the expertise to assess unique circumstances and recommend tailored strategies for debt management and financial recovery.

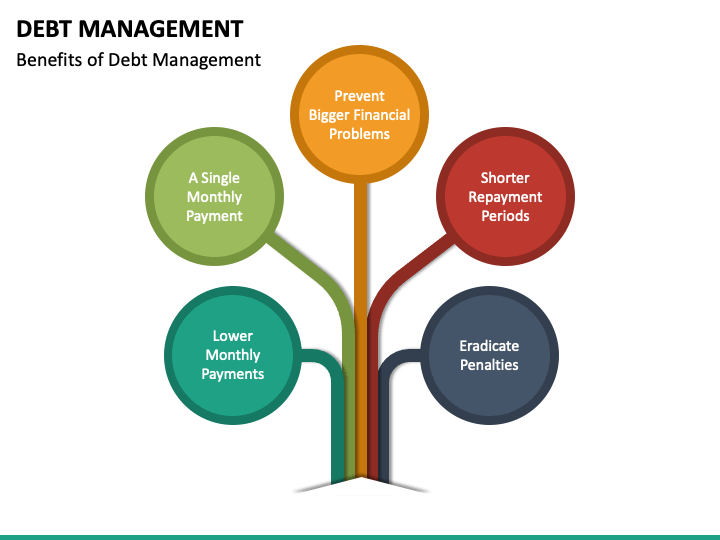

The Benefits of Effective Debt Management:

Implementing robust debt management strategies offers numerous benefits, both in the short and long term:

- Reduced Financial Stress: By organizing finances and implementing structured repayment plans, individuals and businesses can alleviate the burden of overwhelming debt, leading to improved mental and emotional well-being.

- Enhanced Creditworthiness: Timely debt repayments and responsible financial behavior contribute to a positive credit history and higher credit scores, enabling access to better borrowing terms and financial opportunities in the future.

- Increased Savings and Wealth Accumulation: By minimizing interest payments and reducing debt burdens, individuals and businesses free up resources that can be redirected towards savings, investments, or other wealth-building endeavors.

- Improved Financial Discipline: Adopting disciplined financial habits such as budgeting, saving, and prudent spending fosters greater financial literacy and resilience, empowering individuals and businesses to navigate future challenges with confidence.

In Summary:

Debt management is a critical aspect of financial success, requiring proactive planning, disciplined execution, and ongoing monitoring. By assessing financial situations, creating structured budgets, prioritizing debts, and exploring consolidation or negotiation options, individuals and businesses can regain control of their finances and embark on a path towards long-term prosperity. Embracing sound debt management practices not only alleviates immediate financial pressures but also lays the foundation for a brighter and more secure financial future. Remember, the journey to financial freedom begins with taking proactive steps to manage and conquer debt effectively.