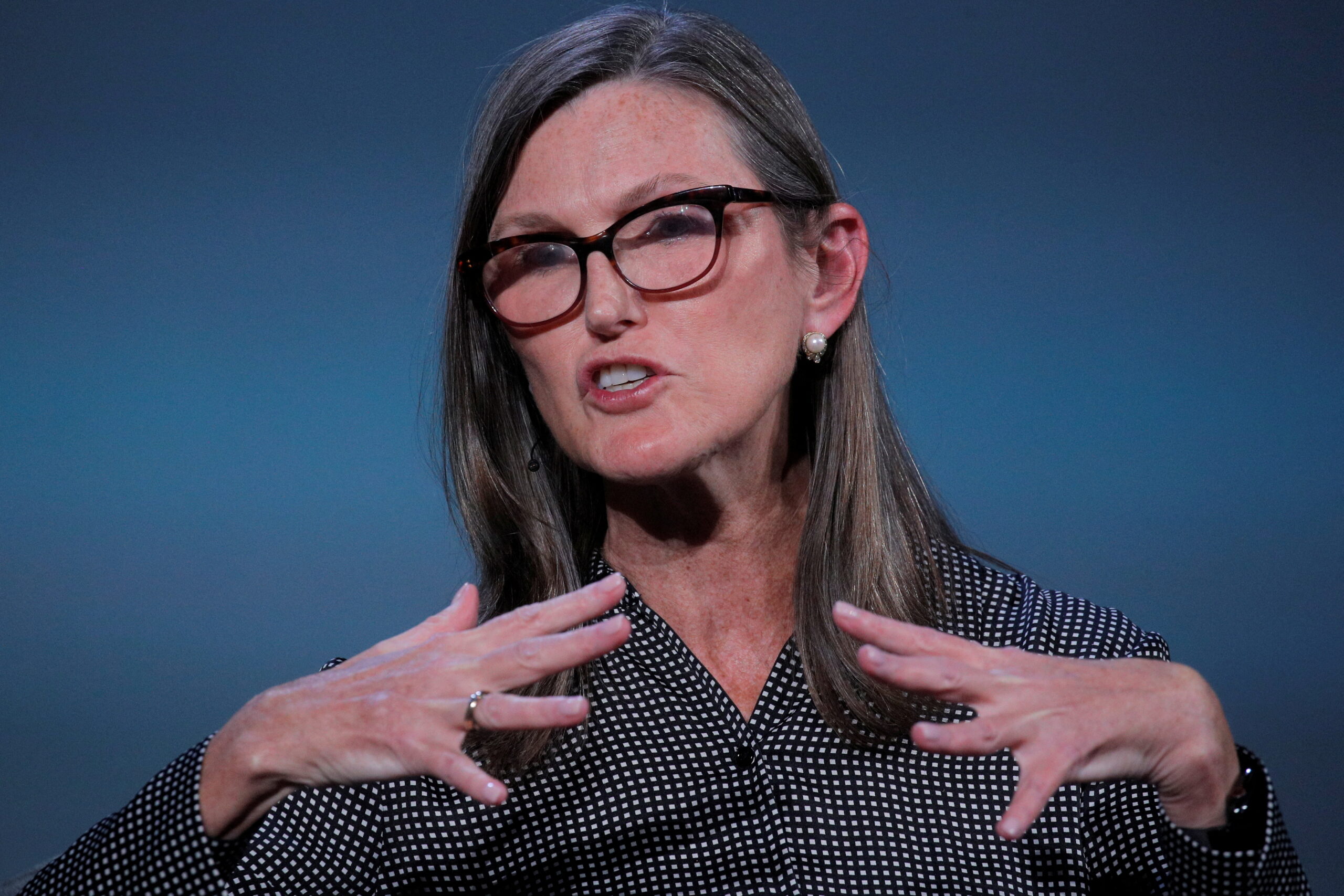

Cathie Wood, the investment visionary known for her bullish bets on disruptive innovation, pulled a fast one on Friday. Just as Coinbase was basking in the afterglow of analyst upgrades and a stellar Q4 report, ARK Invest, Wood’s investment firm, dumped nearly half a million COIN shares, pocketing a cool $90 million. This sudden move has left the crypto-verse scratching its collective head, wondering: Did Cathie Wood see something the rest of us are missing?

The Bull Case for Baffled Brows:

On the surface, the sale seems counterintuitive. Coinbase exceeded expectations, boasting impressive user growth and surging transaction volume. Several analysts responded with bullish upgrades, painting a rosy picture for the crypto exchange’s future. So why the sudden divestment? Here are a few possible explanations:

- Target Weighting: ARK is known for its active management style, constantly tinkering with portfolio allocations to maintain target weights for each holding. Perhaps Coinbase simply reached its designated threshold within ARK’s ETFs, necessitating the sale.

- Profit Taking: It’s never wrong to take profits, especially after a significant run-up. Coinbase’s stock price had jumped nearly 50% since the start of the year, presenting ARK with a lucrative opportunity to lock in gains.

- Shifting Focus: Wood is notorious for her long-term investment horizons, but even she adjusts course if she perceives a change in the landscape. Maybe ARK is pivoting its focus towards other disruptive technologies, deeming Coinbase less central to their future vision.

The Bear Case for Battening Down the Hatches:

While the above explanations hold water, some speculate that Wood might have sniffed out hidden troubles brewing beneath Coinbase’s seemingly sunny facade. Here’s the flip side of the coin:

- Regulatory Uncertainty: The crypto industry remains heavily regulated, and Coinbase operates in a complex legal environment. Perhaps Wood anticipates stricter regulations on the horizon, posing a threat to Coinbase’s business model.

- Competition Heats Up: The crypto exchange space is fiercely competitive, with new players emerging constantly. Maybe Wood fears Coinbase losing its edge in the face of mounting competition, impacting its long-term growth potential.

- Macroeconomic Worries: The global economy faces headwinds, with inflation and interest rate hikes looming. Maybe Wood is concerned about a broader market downturn impacting Coinbase’s stock price, prompting her to preemptively sell.

Read:Will India Ride the Bitcoin Halving Wave?

Cathie Wood Verdict: A Cryptic Crystal Ball:

Ultimately, Wood’s motives remain shrouded in secrecy. She hasn’t publicly commented on the sale, leaving the crypto community to dissect her cryptic move. Whether it’s a strategic portfolio adjustment, profit-taking, or a harbinger of unseen risks, one thing’s for sure: Cathie Wood’s decision has sparked debate and ignited speculation within the cryptosphere. Only time will tell if her move was a stroke of genius or a missed opportunity, but one thing’s certain: the saga of Cathie Wood and Coinbase is far from over.