The cryptocurrency market witnessed a significant movement over the past four days, with a prominent whale making waves. This anonymous entity, often referred to as a “whale” due to the vast amount of cryptocurrency they hold, has withdrawn a staggering 1,200 Bitcoin (BTC) from the Binance exchange.

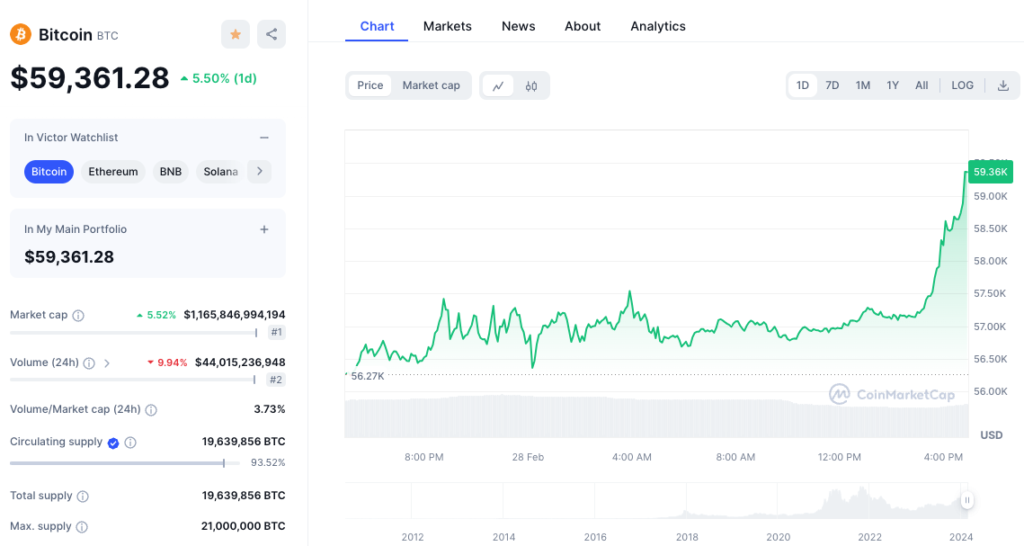

This withdrawal, valued at approximately $63.2 million at the time of the transaction (based on an average price of $52,648 per BTC), has sent ripples through the crypto community. While the exact motivations behind the whale’s actions remain unclear, analysts and enthusiasts are scrambling to decipher the potential implications.

Will Binance Feel the Impact of the Whale’s Departure?

The most immediate question surrounding the withdrawal is whether the whale is attempting to capitalize on a perceived short-term price increase or signaling a broader shift in sentiment. Currently, the whale is sitting on an unrealized profit of $4.75 million, representing a 7.51% gain on their BTC holdings. This suggests the possibility of a short-term trade, aiming to lock in profits before a potential price correction.

However, some analysts believe this move could be indicative of a longer-term strategy. The withdrawal could signal a loss of confidence in centralized exchanges, prompting the whale to move their holdings to a self-custodial wallet for increased security and control. Additionally, the whale might be anticipating a significant price surge in the future and is simply securing their holdings in anticipation of this potential scenario.

Market Reactions and Speculative Frenzy

The news of the whale’s withdrawal has unsurprisingly triggered a flurry of activity and speculation within the crypto community. Social media platforms dedicated to cryptocurrency discussions are abuzz with theories and interpretations. Some see this as a bullish sign, suggesting that whales are accumulating BTC in anticipation of a future price rally. Others remain cautious, highlighting the potential for increased volatility in the short term.

Transparency and the Elusive Nature of Whales

The lack of transparency surrounding the whale’s identity and intentions further fuels the ongoing speculation. Unlike traditional financial markets, the cryptocurrency space often operates with a degree of anonymity. While this anonymity offers certain advantages, it also makes it challenging to definitively interpret the actions of large players like whales.

Read: Bitcoin EFT: Will the Halving Be a Rock Anthem for the Bull Run?

How Can Binance Adapt to the Evolving Landscape of Crypto Whales?

In the coming days and weeks, it will be crucial to observe how the market reacts to this significant withdrawal. If the price of BTC experiences a notable increase, it could lend credence to the theory of the whale attempting to capitalize on a short-term opportunity. Conversely, if the market remains relatively stable or experiences a downturn, it might suggest a longer-term play or a loss of confidence in centralized exchanges.

Regardless of the specific motivations behind the whale’s move, this event serves as a reminder of the significant influence that large holders can have on the cryptocurrency market. As the crypto space continues to evolve, understanding the actions and potential intentions of these enigmatic whales will remain a critical factor in navigating the ever-changing landscape.